Those that are in the Pinecrest, FL area are going to have a lot of insurance needs. A form of coverage that all people should consider obtaining is umbrella insurance. When you do get an umbrella plan, it is going to provide you with more blanket coverage to offset your personal liability risks. There are various reasons that someone should obtain this form of insurance.

Protect Against Serious Claims

A reason that you should get an umbrella insurance plan in Florida is so you can protect yourself against serious claims. If you have an auto or home coverage plan, you will have liability protection up to your policy limit. While this is more than enough in most situations, if there is a major accident that comes with serious damages it could exceed your policy. In these cases, you will want to have an umbrella plan to offer coverage on top of your base policy.

Protect Against More Risks

You also should consider getting an umbrella plan to receive protection against more risks. A primary advantage of umbrella coverage is that it provides you with broad coverage and protection. With this type of coverage, you can receive protection for a wide range of liability risks. Many of these would not be covered by your existing home or auto insurance plans.

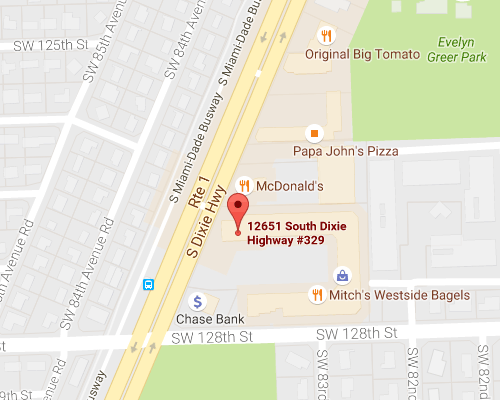

As you are looking to build your personal insurance plan in the Pinecrest, FL area, getting an umbrella plan should be considered a necessity. When you are assessing your options here, Hamilton Fox & Company Inc. can provide you with the support needed to evaluate your options and build an appropriate plan. Hamilton Fox & Company Inc. is able to do this by taking a personalized approach and giving customized guidance.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions