According to the National Fire Protection Association, 358,500 house fires occurred on average in the United States during the years 2011 to 2015. On average for each of these years, 2,510 people died, and 12,300 people were injured as a result of these kinds of fires. House fires have resulted in an average damage of $6.7 billion a year.

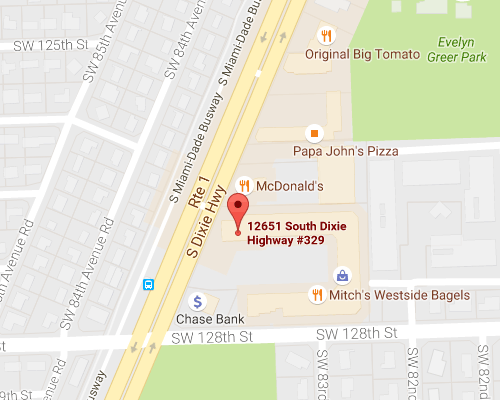

Are there ways that you can avoid becoming part of these statistics? Hamilton Fox & Company Inc., serving Pinecrest, FL, has a few tips:

- You should never let an open flame be unattended. Open flames include candles, fires in fireplaces inside the house, and barbecue grills and fire pits outside the house. An errant ember can lead to a conflagration that will put you and your family’s lives at risk while possibly destroying your home

- Keep cooking surfaces clean of grease. Grease fires are one of the leading causes of house fires. Try not to leave something cooking on the stove unattended

- Make sure smoke detectors are in every room and a fire extinguisher is readily available. Stopping a small fire before it becomes a big one can prevent your home from being damaged or destroyed

- Be sure your yard is clear of dead leaves and other brush that can prove to be a fire hazard

- If you smoke cigarettes, never smoke in bed, and be sure to douse the spent butts with some water before disposing of them

- Have a plan for evacuating the house in case a fire occurs and gets out of control. Note escape routes and means of exiting the house

If you have any more questions about home insurance, feel free to contact Hamilton Fox & Company Inc. serving Pinecrest, FL. Our agents can explain the many benefits of having a policy.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions